Assessment explains how BI vendors can easily solve the problem

By Lawson Abinanti, Messages that Matter

For the 10th year in a row, lack of differentiation permeates the Business Intelligence & Analytics market which made me imagine why and how to solve the problem.

For the 10th year in a row, lack of differentiation permeates the Business Intelligence & Analytics market which made me imagine why and how to solve the problem.

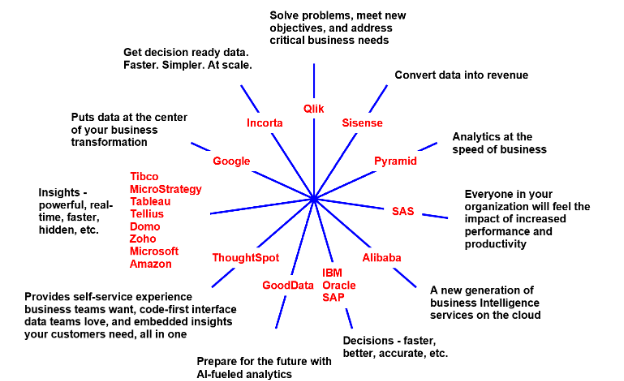

The solution to the lack of differentiation problem is relatively straightforward. Just check out the competitive map (Figure 1) below as one piece of the solution.

Why there’s lack of differentiation in the BI market is perplexing. It’s hard to imagine how eleven of the 20 vendors evaluated in my annual assessment of the Business Intelligence (BI) market have the same position as at least two competitors. Eight have “insights” positions. Three have “decision” positions.

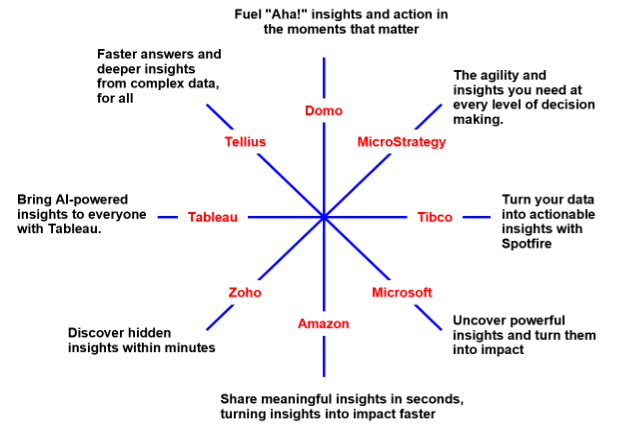

Perplexing me further, as of early March 2024, “insights” is how seven BI vendors were positioned. But apparently those responsible for positioning at Tableau didn’t notice the popularity of the “insights” position or they might not have come up with:

“Bring AI-powered insights to everyone with Tableau.”

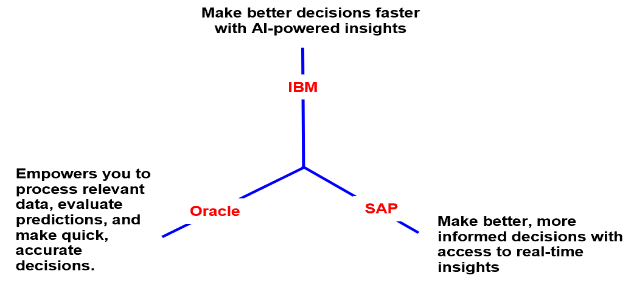

Adding to my perplexity is that “Insights” is how IBM and SAP help you make better decisions. Their positions are remarkably similar:

IBM: “Make better decisions faster with AI-powered insights”

SAP: “Make better, more informed decisions with access to real-time insights”

This sea of sameness makes me wonder why these BI vendors position the way they do. I’ll share what might be the reasons and the solutions but first I’ll share my definition of positioning.

What is a position?

I’m providing my definition for two reasons. First there are many different definitions of positioning. More importantly my definition of positioning will help you put this assessment in perspective.

I define a position as the mental space in your target audience’s mind that you can occupy with a benefit claim that solves a pressing target audience problem. It’s in this mental space where your solution to a target audience problem meet and form a meaningful relationship.

This means BI vendors need to identify the target buyer’s pressing problems ranked by importance and then determine how competitors are positioned.

If BI vendors had a competitive map like Figure 1 below during their positioning process they might not have gone with an “insights” or “decisions” position.

This competitive map created on May 14, 2024 also indicates that several BI vendors don’t factor customer problems into their positioning creation process. Instead they explain what they do but not why the target buyer should care enough to learn more:

Figure 1

Why most positions (but not all) won’t resonate

Two factors should be taken into account when you do positioning – customer problems and competitors’ positions. Once you have a list of target audience problems, ranked by importance, you create potential positioning statements that solve one of the problems. Go with the one that is unique.

The ideal position makes it clear what you do and why the target buyer should care because the expressed benefit solves a pressing problem. These BI vendors only explain what they do and not why the target buyer should care; i.e., a benefit: Qlik, Pyramid, Alibaba and GoodData.

Differentiation helps BI buyers make fast decisions according to Neuromarketing, a must-read book for those responsible for positioning especially in the BI market. Lack of differentiation causes buyer confusion, long sales cycles and the dreaded no decision.

Therefore the eight vendors claiming “insights” and the three claiming “decisions” are shooting themselves in the foot. Their marketing isn’t likely to achieve its full potential.

Google is another BI vendor whose marketing won’t get noticed because its “business transformation” position while unique to the BI market can’t be proved. That’s because the best data in the world can’t possibly transform a business. Plus the “transformation” claim is one of the most overused positions in B2B software marketing.

Also it is important to know that the decision-making portion of the brain seeks evidence to make a fast decision. Differentiation provides that evidence. Yet only three BI vendors – Sisense, SAS and Incorta – have unique positions.

Given that there are a lot of smart, well-educated marketing and product marketing professionals working for all of the BI vendors, it makes me wonder how lack of differentiation can be such a problem. Or why “insights” is such a popular claim in the BI market.

Insights are everywhere in the BI market

One clear finding from my research is that you should only use “insights” if you want to blend in and sound like everyone else. It is the most popular, overused claim in B2B technology marketing. In the BI market it is used by almost all vendors, and some quite extensively.

Using “insights” as your position is a great way to get ignored by target buyers. They don’t go to sleep thinking I need “insights.” They go to sleep thinking “I’m looking for an answer to my problem” or “I need to better understand my situation so I can figure out what actions I need to take.”

There are many ways to claim “insights” as this competitive map indicates:

Figure 2

Let’s take a closer look at “decisions” positions

It’s pretty rare to find a B2B software company not using “decisions” in their marketing. And it is common to find several companies in most B2B markets positioning around the notion of “decisions.” In past assessments, a “decisions” position was much more popular so it is somewhat surprising that only three BI vendors use “decisions” as their position now.

However, two vendors – IBM and SAP – take lack of differentiation to a new level. Their “decisions” position is made possible by “insights.” See how similar their “decisions” positions are:

Figure 3

Last thoughts

There can only be two ways to explain lack of differentiation in the BI market. Vendors either ignore competitors’ marketing and positioning or they think competitors are positioning so effectively that they copy them.

Several top-notch marketing consultants have pointed out the copycat mentality of some B2B marketing professionals. It’s an approach that’s hard for me to understand and accept but perhaps that explains why so many BI vendors have such similar positions. As pointed out earlier, this approach negatively impacts awareness and demand.

Another more concrete reason for lack of differentiation in the BI market is that vendors don’t pay attention to their competitors’ marketing especially their websites. That’s where they can easily determine how their competitors are positioned.

Therefore BI vendors should monitor competitors’ websites and marketing on a regular basis so they know how competitors are positioned and when they change positions.

If you don’t have the manpower or the expertise to do this, check out my “Monitoring and Alerting” service.

A change tells you it’s time to evaluate the competitor in more detail. It could signal a new strategy, a new CMO/marketing executive, a change at the management level and other ramifications that tell you that you need to monitor the competitor in more detail and then on a regular basis.

By always knowing how competitors are positioned, BI vendors can use this intelligence to avoid positions competitors are claiming and come up with a position that stands out instead of blending in like so many BI vendors are currently doing.